In the dynamic landscape of risk management, Lockton Track Insurance stands out as a beacon of expertise and reliability. With a legacy spanning over seven years, Lockton has established itself as a frontrunner in providing comprehensive insurance solutions tailored to meet the unique needs of businesses in an ever-evolving world.

Table of Contents

Unraveling the Lockton Track Insurance Advantage

At the heart of Lockton Track Insurance lies a commitment to excellence that transcends conventional industry standards. Let’s delve into the key aspects that make Lockton Track Insurance a trusted partner in risk mitigation:

- Tailored Solutions for Every Industry

- Lockton understands that each industry comes with its own set of challenges and nuances. The company’s approach is not one-size-fits-all but, rather, a meticulous customization of insurance solutions to align with the specific risks faced by businesses in various sectors.

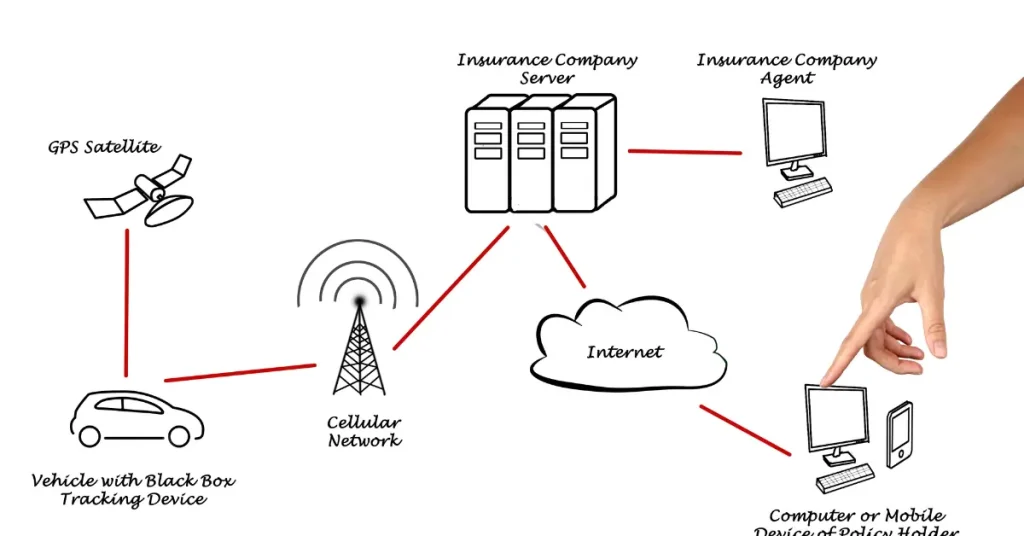

- Cutting-edge Technology Integration

- Staying ahead in the digital age is imperative, and Lockton Track Insurance acknowledges this by incorporating cutting-edge technology. The utilization of advanced analytics and data-driven insights enables Lockton to provide real-time risk assessments, empowering businesses to make informed decisions.

- Global Reach, Local Expertise

- Operating on a global scale, Lockton Track Insurance boasts an extensive network that facilitates seamless coverage across borders. However, the company’s commitment to local expertise ensures that clients receive personalized attention and solutions that are rooted in an understanding of regional nuances.

Unpacking Lockton Track Insurance Offerings

Let’s explore the diverse range of insurance solutions that Lockton Track provides:

| Insurance Type | Key Features |

|---|---|

| Property Insurance | – Comprehensive coverage for physical assets. |

| Liability Insurance | – Protection against legal liabilities and lawsuits. |

| Cyber Insurance | – Safeguarding businesses from cyber threats and attacks. |

| Employee Benefits | – Tailored packages to attract and retain top talent. |

| Specialty Coverages | – Niche solutions for unique industry challenges. |

Client-Centric Approach

Lockton Track Insurance places clients at the forefront of its operations. The client-centric approach is embedded in every interaction, from initial consultations to claim processing. Here’s how Lockton ensures a superior client experience:

- Dedicated Client Advisors: Each client is assigned a dedicated advisor who serves as a single point of contact, ensuring a personalized and efficient service.

- Proactive Risk Management: Lockton goes beyond insurance coverage by actively engaging in risk management strategies. This proactive approach helps clients mitigate risks before they escalate.

- Transparent Communication: Open and transparent communication is a cornerstone of Lockton’s philosophy. Clients are kept informed at every step, fostering trust and long-term partnerships.

Innovative Solutions for Modern Challenges

In an era marked by unprecedented challenges, Lockton Track Insurance rises to the occasion with innovative solutions:

- Climate Change Resilience: Lockton acknowledges the increasing impact of climate change on businesses. The company collaborates with clients to develop strategies that enhance resilience in the face of climate-related risks.

- Digital Transformation Support: As businesses undergo digital transformations, the risk landscape evolves. Lockton assists clients in navigating the complexities of the digital realm, providing insurance solutions that address cyber threats and data breaches.

- Workforce Well-being Programs: Employee well-being is a crucial aspect of risk management. Lockton’s employee benefits programs are designed not only to attract top talent but also to promote the health and wellness of the workforce.

Celebrating One Year of Excellence

As Lockton Track Insurance marks its first-year milestone, it’s a testament to the company’s unwavering commitment to excellence. The journey so far has been marked by successes, innovations, and, most importantly, the trust of clients.

In this short span, Lockton has:

- Expanded its global footprint, reaching new markets and establishing a presence in key regions.

- Introduced state-of-the-art technological enhancements to streamline processes and enhance the overall client experience.

- Continued to evolve its insurance offerings in response to emerging risks and industry trends.

Looking Ahead: A Future of Resilience

As Lockton Track Insurance reflects on its first year, the focus remains on the future. The commitment to providing unparalleled risk management solutions, coupled with a dedication to innovation, positions Lockton as a leader in the insurance industry.

The journey ahead includes:

- Further Global Expansion: Lockton aims to extend its reach, ensuring that businesses worldwide can benefit from its expertise.

- Continuous Technological Advancements: The integration of emerging technologies will remain a priority, as Lockton continues to stay at the forefront of the digital revolution.

- Enhanced Industry Specialization: Lockton will deepen its understanding of specific industries, allowing for even more targeted and effective insurance solutions.

Conclusion

In the realm of risk management, Lockton Track Insurance stands tall as a beacon of excellence, embodying the principles of expertise, innovation, and client-centricity. As we celebrate its first year, we look forward to witnessing the continued impact of Lockton Track in shaping a future where businesses navigate risks with confidence.

What is Lockton Track Insurance?

Lockton Track Insurance is a specialized insurance product offered by Lockton, designed to provide coverage for a specific purpose. It is tailored to meet the unique needs of individuals and businesses involved in [relevant activities].

Who can benefit from Lockton Track Insurance?

Lockton Track Insurance is suitable for [the target audience], such as [examples]. Whether you’re an individual/business] engaged in [specific activities], this insurance is designed to provide the necessary protection.

How to Make a Successful Water Leak Insurance Claim: A Comprehensive Guide

How to Make a Successful Water Leak Insurance Claim: A Comprehensive Guide How Choctaw American Insurance Inc is Revolutionizing the Insurance Industry

How Choctaw American Insurance Inc is Revolutionizing the Insurance Industry Discover 5 Powerful Strategies of Home Insurance Claim Adjusters: Your Essential Guide

Discover 5 Powerful Strategies of Home Insurance Claim Adjusters: Your Essential Guide